California’s worst series of wildfires in state history are barely contained, but the state’s$23 billion cannabis industry has already begun to take stock of the impacts to the trade.

Despite the carnage, the state’s pot economy promises to absorb crop losses, and prices will continue long-term declines, because supplies remain at historic highs. Experts estimate more than 95 percent of California’s crop looks great this year, and is doing vastly better than 2016’s harvest, which was ravaged by mold. Wholesale pounds of cannabis could hit $600 by Thanksgiving, says one industry insider. Retail ounces could fall to $150 per ounce; that’s half off premium prices.

THE CARNAGE

That’s not to diminish the terrible losses among those affected. The 22 wildfires which began Sunday Oct. 8 have charred key cannabis economy epicenters of Mendocino and Sonoma Counties, torching more than 330 square miles of land, more than 5,000 structures, and killing at least 41.

There are thought to be 3,000 to 9,000 cannabis gardens in Sonoma County, and another roughly 10,000 farms in Mendocino. Losses likely total into the hundreds of millions to billions of dollars.

The California Growers Association and the California Cannabis Industry Association report dozens of their members have seen farms burnt to the ground. Thousands of pounds of cannabis likely burned and even more was severely damaged by smoke.

In addition to licensed facilities that had joined such trade groups, “you had a tremendous number of [illicit] farms that were bigger and took total damage to processing facilities, cloning labs, distribution hubs, and extraction labs,” said Kevin Jodrey, who works with a wide swadth of the industry as organizer of the Golden Tarp awards, as well as Wonderland nursery in Humboldt County.

Up to one third of Sonoma and Mendocino’s regional annual outdoor supplies may be affected by the fires, Jodrey said. Toxic smoke has also inundated Mendocino and Sonoma for a week, right at the time of peak harvest.

“You’re going to see a huge reduction in the outdoor quantity that was about to come out,” Jodrey said. “If you weren’t totally burned, you were in the smoke zone.”

Another industry voice —Emerald Cup organizer Tim Blake — estimates maybe three percent of the entire state crop might be affected. “This is beyond anything,” said Blake. “This was so instantaneous and such a huge amount of damage.”

Many are hoping to use chemical extraction to get cannabis oil scrubbed of the smoke smell, but “it’s tough to get that smell out of the flower. The nose is pretty sensitive. It really picks up burning things well,” said Jodrey.

“When you damage that terpene profile with dust and smoke and ash — it’s barbecue bud. In today’s world, they don’t want barbecue bud or barbecue extracts or edibles,” Blake said. “There’s so much good product — you’re competing against A-grade for cheap prices.”

MEGA-SURPLUS OF POT

Despite the heavy losses, California has a massive and diverse cannabis industry that grows an estimated 13 million pounds of cannabis per year. Four out of five of those pounds are shipped out of state to markets like New York, Chicago and Atlanta, while the highest-grade medical and recreational product generally stays here.

Even though Sonoma and Mendocino burned and were covered in smoke, the losses will only dent the massive oversupply of cannabis in the state. For one, many Sonoma and Mendocino cultivators finished harvesting before the fires started. One farm reported being 90 percent done before Oct. 8. Another reported being 70 percent done.

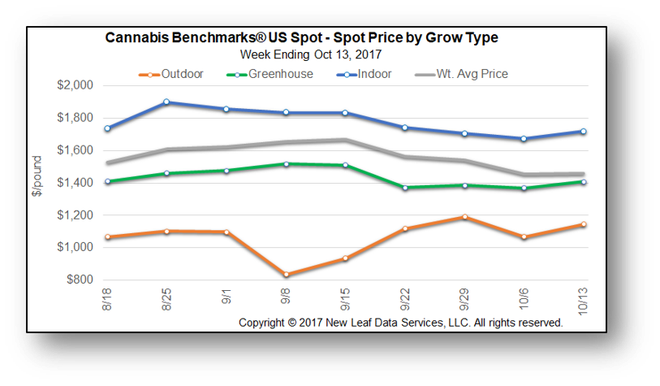

Growers are set to oversupply California this year because of two chief factors. Due to the end of pot prohibition and the risk associated with it, the price of cannabis has been slipping from ‘90s peaks of $5,000 per high-quality indoor pound to under $2,000 now. Consequently, growers plant more each season to overcome lost margins. However, planting more leads to a bigger glut, which further depress prices at harvest time in October and November.

Furthermore, 2017 was the last year farmers could grow unlicensed, unregulated, untaxed and untracked pot for the medical market. Commercial medical and recreational licensing begins Jan. 1. Because of the new rules taking effect, both licit and illicit growers sought to have ‘one more good year’ and went big.

The 2016 growing season probably had more severe crop loss — due to early rains, which caused rampant mold problems. The industry is not reporting any mold problems this year.

“We lost 30 to 40 percent to mold last year,” Blake said. “Not this year.”

So even with the fire loss and smoke damage, California growers were set to bring in their largest harvest ever.

“This year is the largest crop anybody ever dreamed of,” Blake said. “With [Proposition] 64 coming in, we are inundated with quality at reasonable prices.”

DIVERSITY EQUALS STRENGTH

California cannabis is also extremely diversified in terms of geography and farming techniques. Cannabis is grown from the Oregon border down through the southern California deserts; from the shores of Monterey to the border with Nevada.

Massive losses in Sonoma and Mendocino Counties translate into boons for unaffected cultivators, like those in Humboldt, Monterey and Southern California. Humboldt County remains smoke-free, warm and sunny and the fields looked gorgeous.

“The weather right now in Humboldt is superlative,” said Jodrey.

Meanwhile, mega-grows in places like the city of Salinas stand to benefit from decreased competition. The same goes for legal grows in Adelanto, Desert Hot Springs and Cathedral City, where millions of square-feet of canopy space went unaffected by the calamity up north.

“We still have Humboldt, and a majority of Mendocino and Salinas and SoCal picking up the slack,” Jodrey said.

The damage to the Redwood Valley hit “primo growing land,” said Blake, “but it’s a small percentage of the total Emerald Triangle.”

Cannabis is also grown year-round indoors, and year-round outdoors thanks to light deprivation techniques. The year’s light dep harvest promises to supplant what would have been top-grade, full sun outdoor this year.

“The dep is off the hook,” said Jodrey. “We’re lucky in our whole area. My god, this is one of the better cannabis years in history.”

PRICE EFFECTS MUTED

So even though Mendocino and Sonoma burned, cannabis prices are drifting downward as part of a decades-long macroeconomic shift from prohibition markets to legal ones. That shift entails the erosion of as much as 90 percent of the price of pot. Much of that price was the “risk premium” that is going away, as well as the inefficiencies of a non-industrialized crop.

Blake said A-grade light dep started off at $1,500 this summer, “then it fell to 14, 13, 12, 11 and is selling off in the $1,000s.”

And buyers “only want A-grade.”

So, for example an A-grade OG Kush light dep pound might go for $1,100 or $1,200, but “stunning” Chemdawg dep might sell for $900, and other strains could go for cheaper. B-grade is not selling at all, he said.

The hills are full of people sitting on 1,000, 2,000, 4,000 pounds of light dep, and “I mean really what does that mean for all this long-season stuff?” Blake said.

“The Humboldt people are crushing it. When you have 2, 3, or 4,000 pounds sitting in a shed, folks can let some of it go for $1,000 a pound.”

Blake predicts, “By Thanksgiving you’re looking at $600-$700 [outdoor] pounds.”

When pot is $37.50 per ounce wholesale, consumers could see retail ounces going for $150 or so, “because of the glut.”

At best, the record fires could slightly stabilize historic price slides which promised to wipe out a whole class of growers this year — indoor mom and pop operations running two or three lights, said Jodrey.

“There’s an ocean of those people getting knocked out because they can’t compete [on price],” he said. “There was a cleansing happening so quickly, so many of these small people were absolutely on the edge of failure.”

“But when you knock all this outdoor out, this will allow people to survive for another season and they really needed it,” he said. “Now they have enough of a margin to keep going.”

It’s tought to talk about silver linings amidst all this sadness, Jodrey said. But California is no stranger to fire and the cannabis industry has decades of experience with calamity. Last time, Humboldt County burned.

“Ultimately we all suffer and get paid in a cyclical wave,” he said. “That’s the crazy thing about life.”